My 2013 writing income post brought up a number of good questions in the comments. And one odd question about my bedroom habits and whether or not I was a first-rate lover … but that might have been spam. Either way, I’m not going to address that one here. But I did want to talk about the rest.

First off, some relevant links:

And now, on to the questions.

“I’d be curious to see how the income breaks down over time across income types too: advance, d&a, residual…”

A lot depends on the contracts. Advances are often broken into multiple payments. For books three and four of the Magic ex Libris series, I get part of the advance on signing (once DAW has received and processed the signed contracts), part upon the delivery and acceptance (D&A) of the final, revised manuscript, and part on publication. I’ve gotten the on-signing money for books three and four, but that’s all so far. I’ve turned in the manuscript for Unbound, and once my editor gets back to me, I’ll do another revision. When that’s accepted, I’ll get the second portion of the advance (D&A) for that book.

How everything breaks down depends on the size of the advance, too. Say Author X is getting 90% of their money as royalties and only 10% as advance money. This could mean they have a very small advance. It could mean a big advance but the book sold a lot more copies than expected. It could mean a large backlist of titles that have earned out and are generating royalties. If someone never earns out and gets any royalties, does that mean their books don’t sell, or does it mean they got huge advances?

With that said…

- All of my books have earned out their advances, with the exception of Codex Born. (And since Codex Born came out in August 2013, I haven’t seen a royalties statement yet, so it’s possible that one has also earned out. But I doubt it.)

- I signed contracts for three new books in 2013, which means there’s a higher-than-normal proportion of on-signing advance money.

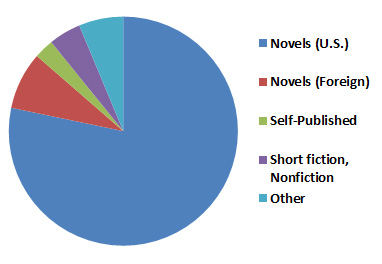

Here’s how the $55,000 or so of U.S. novel income (before taxes) breaks down for 2013.

“Is any of the variation due to publishers paying irregularly?”

DAW operates on six-month royalty periods, 1/1 – 6/30 and 7/1 – 12/31. Since most of my books have earned out their advances, this means I get royalty checks on a fairly regular and predictable twice/year schedule (usually around April and October). The payment process isn’t quick, by any means, but I haven’t had trouble getting paid by the major publishers. I’ve occasionally had smaller checks get delayed or forgotten, but in general, a nudge from either my agent or myself has been enough to shake those loose.

You listed your self-published income. How many titles have you self-published vs. your traditionally published work?

I’m primarily a traditionally published author. My nine fantasy novels are all in print from DAW Books.

I’ve self-published three short collections, which you can see at the bottom of my Bookstore page. I also self-published my non-genre novel Goldfish Dreams.

Given that the majority of my work is published by DAW and other major publishers, it should come as no surprise that most of my income is from those same sources. When those books go out of print with DAW, I certainly plan on self-publishing them myself in order to keep my backlist available.

Personally, I think the whole Self-Publishing vs. Traditional Publishing argument is rather silly, but that hasn’t stopped people from using my initial blog post to show why one side or the other is the Right way to publish. All I’ll say is that this way is working pretty well for me right now.

“How much of that upfront payment do you give away to taxes? If you were to make, say, $60K, would you lose 1/3? 1/2?”

The numbers I posted were pre-tax, which means a chunk of it will be going right back out.

Last year, I paid estimated quarterly taxes that totaled around $5000 (based on my 2012 income) against what I expected to make in 2013. I also have a pretty high deduction on my income from the day job, so some of that spills over to pay for taxes on the writing.

I honestly won’t know how much I’m paying in taxes until I get the rest of our W-2s. A bit of hunting around online for self-employment tax calculators suggests that for self-employment income of $60,000, I could expect to pay a total of about $8500 in federal taxes, and an unknown-but-smaller amount in state taxes. But so much depends on other factors, which means I honestly don’t know.

What about your agent’s cut?

The numbers I posted are after my agent takes his commission.

Why are your expenses so low? Are you forgetting to take some tax deductions?

I messed up a bit on this part, and I apologize for that. The expenses I listed were only those that I had dollar amounts for in my annual writing budget spreadsheet: hotel costs, postage, etc. They omitted things I don’t calculate until I start doing my taxes, like mileage or meal allowances. And I was indeed missing a few deductions — thank you to folks who pointed those out. I’ve always been a bit conservative about taking deductions, though I’m moving away from that.

Having started working on taxes, here’s a better accounting of my writing expenses for 2013, which come to a total of $6,861. Yeah, I really messed up the initial estimate there.

- Mileage: 4,290, which comes to a mileage deduction of $2,424.

- Meal Allowance: $2,517, of which I get to deduct half.

- Parking, tolls, taxi, etc: $684

- Website-related costs: $146

- Postage: $241

- Internet/wireless: $766

- Other: $83

What exactly do you mean by foreign sales? Does your UK deal for Magic ex Libris count?

Good question. I was not counting the UK deal, in part because of how my contracts work. My agent negotiated a deal with DAW wherein DAW gets the rights to publish the books in English in the U.S. and Canada. DAW also gets certain other rights that they can sublicense, including things like putting them out in audio, selling them to a book club (in English), or licensing the UK edition to a UK publisher. I get paid when any of these things happen. As I understand it, these payments are usually applied against the advance, but since Libriomancer earned out pretty quickly, money for the book club, audio books, and UK deal just got bundled in to the royalties payment from DAW.

DAW did not get non-English rights, which means when we sold the Magic ex Libris books to Germany, for example, that deal was directly with me and my agent. When I get paid for those, the money comes from the German publisher to my agent and then to me, instead of going through DAW.

“Do you think your writing income would rise meaningfully if it were your sole job?”

Yes. I don’t know how much, but my hope is that I’d be able to consistently produce at least two books a year, as opposed to the one/year schedule I’ve been on for so long. If I could do that — especially if I could branch out a bit with some of those books — I think it would lead to a significant increase in the writing income.

Or maybe I’d just spend more time blogging and posting on Twitter.

Hopefully someday I’ll be able to put that to the test.

Goblin Quest

Goblin Quest

I figured the reason for the drop was pretty straightforward: I didn’t sell any new books to my U.S. publisher last year. The deal for Libriomancer and Codex Born was made in 2011, and while I have ideas for book three in the series, I haven’t pitched it yet. So while 2012 saw some money for delivering the final manuscript for Libriomancer and the on-publication payment, it wasn’t as much as the on-signing advance for those two books last year.

I figured the reason for the drop was pretty straightforward: I didn’t sell any new books to my U.S. publisher last year. The deal for Libriomancer and Codex Born was made in 2011, and while I have ideas for book three in the series, I haven’t pitched it yet. So while 2012 saw some money for delivering the final manuscript for Libriomancer and the on-publication payment, it wasn’t as much as the on-signing advance for those two books last year.