Imprinted: One Month Update

“Imprinted,” my Magic ex Libris novelette, has been out for about a month. This was something of an experiment — my first original self-published tie-in title. Thus far, I think the experiment has been going well. Reviews are pretty positive, and the first month’s sales have been good enough to make me think I should to this again.

“Imprinted,” my Magic ex Libris novelette, has been out for about a month. This was something of an experiment — my first original self-published tie-in title. Thus far, I think the experiment has been going well. Reviews are pretty positive, and the first month’s sales have been good enough to make me think I should to this again.

I figured people would primarily buy the ebook, and the numbers bear that out with a total of 775 sales so far. But to my surprise and delight, 101 people opted for the print version. That’s much more than I expected, and tells me it’s worth taking the time to create a print edition to go with the ebook.

My only frustration on the print side was that CreateSpace couldn’t get me copies in time for me to take them to ConFusion.

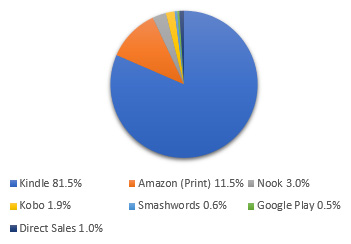

Almost all of the sales have come from Amazon, which was pretty much what I expected. Here’s the breakdown on sales channels. (iBooks is bundled into the Smashwords sales.)

- Kindle: 714

- Nook: 26

- Kobo: 17

- Smashwords: 5

- Google Play: 4

- Direct Sales: 9

Total income, before taxes, is just over $1,800.

Back when I started this project, I was torn between pricing the ebook at $2.99 or $1.99. The big difference is in how royalties are calculated. Years ago, Amazon began offering 70% royalties if your ebook was priced between $2.99 and $9.99. Everyone else more or less followed suit.

What this means is that the current price of $2.99 earns me roughly two bucks per sale. Pricing the same ebook at $1.99 means the royalties drop to 35%, or roughly seventy cents per sale. In other words, cutting the price by 1/3 would cut my royalties by 2/3. A lot of people said they’d happily pay the higher price to support me. (THANK YOU SO MUCH!!!)

I decided I’d start with $2.99, and after a month or so, I’d drop the price to $1.99. I’ll be making that price cut early next week. So if you’re feeling generous and want to give me that larger royalty bump, you’ve got a few more days. If you prefer to save a buck — which I totally understand and respect — check back next week.

Here are the sales links:

- PAPERBACK: Amazon

- EBOOK: Amazon | B&N | Smashwords | Kobo | iBooks

- BUY DIRECT: Receive the book in .mobi, .epub, and .pdf formats.

This has been Five Minutes of Self-Publishing Business Navel-Gazing. (Not to be confused with Naval-Glazing.)

Tara

February 8, 2018 @ 3:00 pm

As always, fascinating to read your stats/reports on your self-publishing experiments! Really appreciate your openness.

Since common self-publishing wisdom is that $1.99 is the worst price-point (since, as you say, 2.99 gets you 70% but 1.99 gets you 35% and 1.99 also isn’t as attractively cheap as 0.99) I wonder how that price-point does for you. Maybe 1.99 is a better price-point than a lot of people think. Self-publishing is always changing, after all.

Avilyn

February 8, 2018 @ 5:44 pm

I thoroughly enjoyed Imprinted, and am hoping its success means we’ll be seeing other short works in that world. 😉 Congrats!

Jim C. Hines

February 8, 2018 @ 6:26 pm

Avilyn – thank you! And that’s the plan 🙂

Laura Resnick

February 8, 2018 @ 9:01 pm

Thank you for posting candidly about this. I’ve been thinking about doing something similar, so I find it helpful to read a breakdown of real world experience with such an experiment.

KatG

February 8, 2018 @ 9:22 pm

One more time into the breach — what Amazon pays you for self-published works are NOT royalties. They call them that, but it’s a lie. Amazon does not have a contracted exclusive license to produce and sell your work as its version with their own investment and pay you royalties, a cut, on such a license. They don’t pay you a proportion of the income they are getting from them selling your work as theirs in partnership with you.

They just charge you fees on your sales revenue. What Amazon and Smashwords, etc. pay you is your revenue from your sales of the work on their platform/market stall after they deduct their formatting, distribution and accounting fees, like a printer or a distribution company would for doing services on a print book.

For books in the $2.99-9.99 price, Amazon charges service fees equal to 30 percent of gross revenue, which are deducted as business expenses from your gross revenues — same as you deduct your home office supplies, convention trip expenses, literary agent fees and hiring a freelance copy-editor as business expenses — giving you net profits. For books at a lower price point that you set as your own publishing business, Amazon charges higher service fees of 65%, which is ridiculous but they virtually own the service market.

Not royalties. Royalties and revenues are two different types of income streams. And you may have to account them differently on your taxes. It drives me crazy. They’ve been doing this for over a decade and it’s just a dishonest business practice that makes authors run their self-publishing businesses badly, especially on accounting and calculating expenses.

So your total gross income from the book was not $1,800, unless that’s the total amount pre-Amazon deduction of service fees. Your total gross income from the project would be around $2,570. You paid e-book vendors like Amazon around $770 in service fees, that deducted from your gross revenues equals a net profit of $1,800. Then you further deduct a portion of that net for the various other business expenses that you have (as part of your total income from all your different writing and business income streams, including actual royalty income from DAW.) And that will leave you with your net taxable income, which is between you and your tax accountant. But legally, you should be declaring the entire $2,570 as your income on the right tax form, then deducting all the expenses including the e-book vender service fees on Schedule D, etc.

Your gross income — $2570 — is what you earned on the product, the e-book. When all the expenses are deducted, including the e-book vendor service fees, you end up with your net taxable income and that is your net profit. That tells you how much you actually earned after expenses, whereas the gross income — $2,570 — tells you how well the project actually sold. So the work is then doing better than what you said in sales income, but the substantial business expenses reduce the profit income. But you have to start the calculations with the gross income because Amazon, Smashwords, Kobo, Nook, etc., and CreateSpace are NOT your publishers. They are your printer/distributors who charge you fees — just like Ingrams charges publishers for wholesale distribution. You’re the (self) publisher getting revenue, not an author getting royalties from a publisher partner, for this particular project.

It may make sense for authors who are doing a lot of self-publishing to look into the various options for sole proprietorship businesses as setting up your operation as a separate publishing company for which you file a separate set of taxes, rather than as a sole professional like a lawyer or freelancer. It depends on a lot of factors. Which is why it’s important to label income sources and expenses properly. Amazon doesn’t do this, which is really bad of them.

In any case, congrats on Imprinted doing well as an initial experiment.